About Terramont

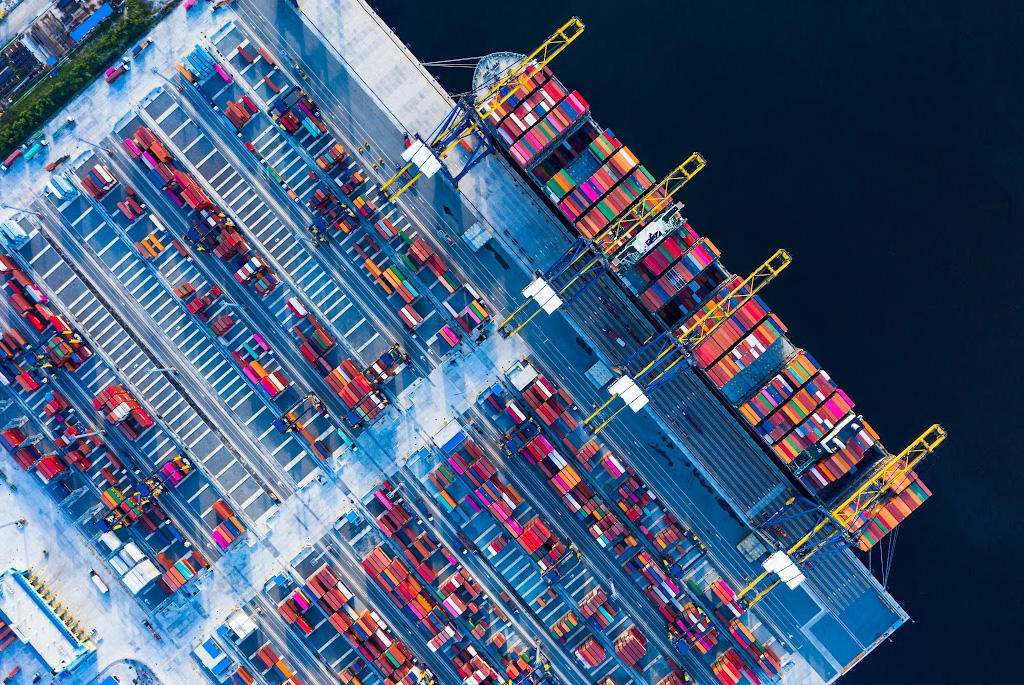

Terramont Infrastructure Partners is a North American financial sponsor specializing in middle-market infrastructure businesses. Terramont invests in businesses that develop, own, and operate assets that provide essential services. Our portfolio companies have an established competitive positioning, and operate in markets with high barriers to entry.

We partner with top-tier management teams with whom we build institutional quality businesses. Our collaborative approach ensures that each investment not only thrives financially, but also positively contributes to our local communities and environment.

We are an entrepreneurial team of investment professionals with decades of experience investing in, scaling, and operating infrastructure businesses.

Founders’ investment

experience

Capital invested

Investments

Sectors

Terramont Infrastructure

Partners

Team members

Platform assets

Employees in portfolio

We believe that great investments are built on trust and relationships